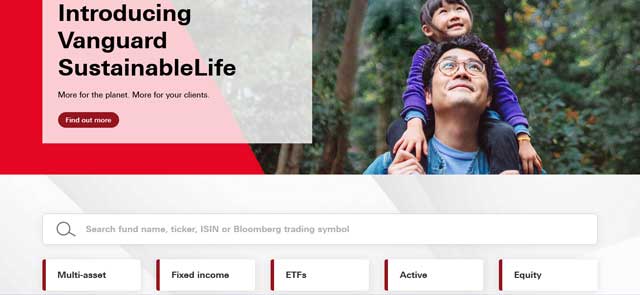

What are Vanguard Funds, and How do They Work? Vanguard Target retirement, Lifestrategy, Active, and Index Funds are some options in VanVanguard is an excellent option for those interested in ETFs or index funds. Vanguard, one of the most well-known investment platforms, has been based in the USA since 1975 but also offers an excellent online service for UK investors. What are the best Vanguard funds you can buy right now? It’s wise to look at Vanguard funds that have the highest performance over a given period if you’re investing.

Much information is available on the subject, and Vanguard offers many investment options. Let’s now look at Vanguard’s various investment options and funds. These have the potential for a good return over the next few years.

Note: It is important to remember that past reports do never assure future performance.

What is Vanguard Funds Index, and How do They Work

Vanguard was founded in 1975 and managed a wide array of funds. It handles everything, from index funds to ETFs and even mutual funds. Vanguard is now open to retail investors in the UK. You can now directly invest from the retailer’s site. You can do that at a minimum of £500 lump sum or, per month, £100. One can access Vanguard funds at multiple brokers regulated by FCA.

Vanguard funds enable you to access the financial markets passively. That is particularly attractive for those who don’t have any experience with stock picking. Another benefit to investing in Vanguard funds is accessing hard-to-reach asset types. That includes stocks and bonds, even from new markets.

Vanguard UK Funds Types

Vanguard has many funds available in the UK. The provider usually divides funds into these prime categories.

- Lifestrategy: It includes various stock/bond splits with a long-term plan.

- Target Retirement: It allows you to define a retirement year. Vanguard will adjust the portfolio automatically based on multiple factors.

- Mutual Fund: It is such an investment type that Vanguard manages actively.

- ETFs: Funds listed on public exchanges are covered under this category

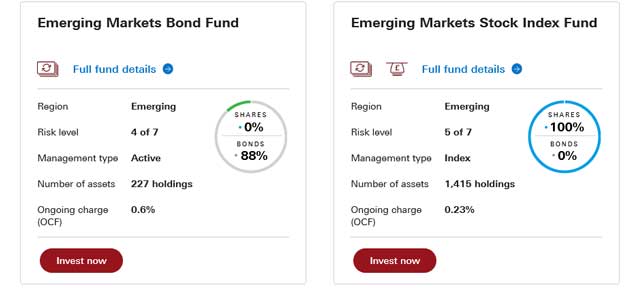

Vanguard Asset Types

Then you can choose the asset to which you want to be exposed.

- Equities: It will invest 100% funds in stocks

- Income: System will invest 100% of funds in income-giving bonds

- Blended: System will mix funds between bonds and equities.

- Money Market: These funds are highly low-risk, and one will invest in them for short-term goals. These investment products allocate funds to high-quality government securities and bank deposits.

ETFs vs Index Funds

Vanguard has a variety of funds and ETFs that can be accessed online by their customers. Let’s first look at the differences between the Vanguard fund types before discussing the best Vanguard funds.

Mutual funds – It is the mix of all funds that fall under this category, such as active funds, index funds, blended funds, and bonds.

ETFs are a bit like stocks in that sense, as you can trade them at any point during a business day.

Exchange Traded Funds differ from index funds, where the price is figured only once daily. ETFs are often preferred over mutual funds because investments are more diminutive. ETFs are generally less expensive to operate, and fees are lower than bonds or mutual funds. These ETFs can be a good choice for beginners investors.

Target Retirement vs LifeStrategy

Vanguard offers blended funds, where you can invest in packaged equities and bonds. Vanguard offers two types of blended funds: LifeStrategy and Target Retirement.

LifeStrategy allows you to choose from five different combinations of equities and bonds. You can choose from 20% equity or 80% bonds, up to 100% equity. That is a passive approach. At the same time, the active approach allows selecting funds and ETFs at your own will. It is ideal for those new to investing or simply looking for a more passive approach.

You can also manage your Target Retirement funds on your behalf. They are built with your risk tolerance and retirement date. Moreover, these funds can also be split into equity and bonds. As you get closer to your retirement date, they will automatically adjust towards a higher allocation of bonds.

Best Vanguard Index Funds

It would be best to look at the data from the last 3-5 years when trying to find the best Vanguard UK index funds. It is important to remember that past reports do not assure future performance. This approach is not the best performance indicator but it is a good starting point. This guide will use data from the last three years to calculate the performance. Below are the top index funds at Vanguard UK based on the recent version.

US Equity Index Fund: This index fund has experienced 48.12% growth over the past three years, with a total growth rate of 516.99% since its inception. This index fund is the most successful in this category.

FTSE Developed World ex UK Equity Index Fund: This index fund is quite a mouthful and is still the most performing equity fund. This index fund has seen a 34.84% growth over the past three years.

ESG Developed World All Cap Equity Index Fund: This developed fund has had a 35.46% growth rate over the past three years.

We are not examining diversification levels or the regular fees. However, we do not endorse this as a recommendation, do your research before taking any decision.

Best Vanguard Active Funds

The following are the top active funds with the highest performance in the last three years.

Global Equity Fund After a difficult 2020, the ROI has been steady and stable, with 44.3% growth in the last three years.

Global Emerging Markets Fund: Similar to the previous, the fund experienced a significant dip at the beginning of Covid-19. However, the fund has recovered since then with a 26.33% growth.

Global Credit Bond Fund: This hedged investor accumulation rounds out the third position. It has rebounded strongly since early 2020. The three-year average growth rate is 21.26%, compared to the benchmark of 14.44%.

Vanguard LifeStrategy Options

As we discuss above, there are five combinations available in LifeStrategy.

LifeStrategy funds allow you to choose between equity or bond splits. That means that you can pick from one of the packages depending on your preferences:

- 20% Equity and 80% bonds

- 40% Equity and 60% bonds

- 60% Equity and 40% Bonds

- 80% Equity and 20% bonds

- 100% Equity

Higher equity shares mean higher risk factors. Remember, one should take past performance with a grain of salt. If this is a concern, check those numbers in conjunction with Vanguard’s risk assessment.

Target Retirement Fund Options

Vanguard currently has 11 funds under target retirement. They are first available starting in 2015 and 2020, then moving on to 2065. These funds’ titles are after the date you will likely retire, as you might have noticed. Anyone born after 2000 could consider the 2060 and 2065 funds based on their state retirement age. However, these funds may be a good option if you want to retire earlier. You might also consider 2050 or earlier.

If you’re looking at performance statistics across all retirement funds, there are many of data to crunch. Let’s take a quick look at the five-year facts. As of February 2021, the 2015 fund had a five-year growth rate of 38.45%. The 2035 fund’s five-year performance is 58.94%. The 2055 fund is currently the most recent fund option, with 5-year growth at 64.72%.

This data shows that the five-year growth rate is higher for those who retire later than the average. That is normal because of the way Target Retirement is built. If the retirement date is near, more allocations of safer investments (e.g. bonds) are made.

Conclusion

Vanguard tries to cover all bases. They have several ETFs and funds options to choose from that are very healthy. Many options are available, but no single option will be the best. It is essential to consider how you would like to invest, how much you are willing to contribute, and when you wish to retire.

You don’t have to choose the best Vanguard funds based on past performance. Instead, it would help if you considered a more comprehensive range.

Inactive investment approach don’t want the hassle of picking individual funds; they will be more interested in the LifeStrategy blend funds. Another option is to make passive investments elsewhere through a well-known UK platform like Nutmeg. No matter what you do, consider critical factors such as your involvement, the fund and account options, and the fees.