This Vanguard vs InvestEngine comparison considers all the features linked to investment decision-making. We will try to analyze how both of these platforms perform and which one is best for what type of investment needs. I will also review the platform’s investment options, fees, and whether it is the best broker platform for your needs. We will also examine the pros and cons associated with InvestEngine and Vanguard.

Vanguard Vs InvestEngine: Which is the Right Option for me?

Is Vanguard Good to Go? – An Overview

Vanguard’s brokerage online platform focuses on long-term investors who want to buy and hold. Vanguard’s investing philosophy is John C. Bogle’s. That includes active trading, not giving many benefits, fees should be low, and newcomers must have lots of guidance.

Vanguard might be the right choice for you if all you want is an online brokerage platform to supplement your 401k plan or you just want to grow funds in a taxable brokerage account. Moreover, you also want to be pain-free about market changes.

In some aspects, Vanguard may seem a bit outdated, even for investors looking to buy and hold. That includes the slow process of opening an account. Although one can fill up an application online, you will need a manual review for approval and activation of your account.

Vanguard’s platform is not designed to allow for fast and smooth trading. Overall, the company doesn’t want to compete with modern brokerages, which offer a complete range of tools required for frequent trading.

Vanguard might be a good fit for someone who clearly understands their long-term objectives. And are just looking to know how funds will perform after investment in one option or another. This type of investing is more slow-paced than active stock trading.

Is InvestEngine Good to Go? – An Overview

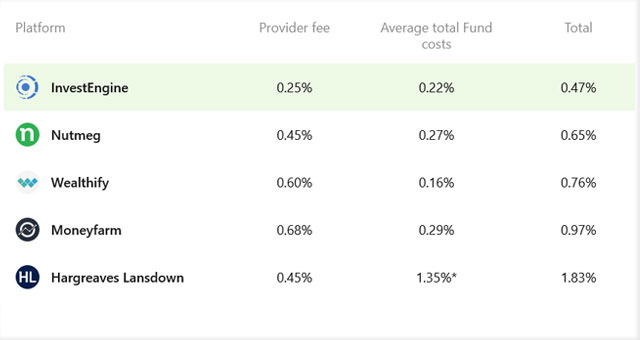

Although InvestEngine is a new entrant, it stands out with its strategy in DIY investment products. InvestEngine aims to bring together the best range of existing market competitors. Features you can get with InvestEngine include zero platform fee on DIY portfolios, Zero exit fees, and one-click re-balancing. All these features ensure that it gains goodwill with both novice and expert investors. Moreover, its low-cost model is a strong competitor to other established Robo-advising platforms like Nutmeg and Hargreaves Lansdown.

Although InvestEngine is imperfect in some areas as it does not offer direct shares trading or pension investment options, it is still an excellent platform for people who want to deal in ETFs only. One can explore the investment portfolios by simple account registration. It won’t matter if you invest or not. It is best for the novice and passive investors looking for a portfolio managed for them but with expert knowledge. On the other side, it also caters to experienced investors looking to work and make their portfolio with a DIY option.

Products and Offers: InvestEngine vs Vanguard

What Vanguard Offers

Stocks and ETFs are long-term; short sales are limited.

Mutual funds include 130 Vanguard funds and 14,000+ non-Vanguard, of which more than 3,100 are free to trade online.

Bonds include Corporate and Municipal, Treasury, and CDs.

OTCBB (Penny Stocks).

Options which include both Multi-leg and single leg

You will also access Vanguard Personal Advisory Services & Vanguard Digital Advisor at a minimal cost.

International Exchange: You must use a live broker to purchase shares on international exchanges. But you will not get it from the Vanguard Platform.

What InvestEngine Offers

InvestEngine solely deals in ETFs, with more than 150 investment options available. It covers a variety of bonds, stock markets, and commodities. The Look Through feature on the portal allows you to break down either individual ETFs or whole portfolios using different filters, i.e. asset type, geographic location, or company. Bonds are the prime component in the managed portfolio while keeping the income and low-risk aspects in mind.

Fees and Pricing: InvestEngine vs Vanguard

Vanguard Fees and Rates

Vanguard is renowned for its transparency and low fees. The company offers a detailed explanation of all prices and the total cost of investing before you decide to invest with them. Some fees vary depending on the type of investment you choose to initiate.

Vanguard does not charge commissions for ETF, OTCBB, or online equity trades. The base commission remains the same for any number of shares that you trade. Options trades are not subject to a per-leg commission. The commission for one options contract is $1. Obviously, it’s significantly on the higher side than other competitors. i.e. If you are dealing with 70 options’ contracts, it will cost $70

If you have less than $1,000,000 in Vanguard ETF or mutual fund assets, the transaction fee is $20 for mutual fund trade, which is $25 when using the broker-assisted feature. On the other hand, if you have $1-5 million in Vanguard ETF or mutual fund, you can enjoy a $0 fee for the first 25 trades and an $8 fee/trade after that. Similarly, if you have $5 million+ in Vanguard ETF or mutual fund can enjoy a $0 fee for the first 100 trades and an $8 fee/trade thereafter. Vanguard charges $25 per trade if you use a live broker. Live brokers are free with accounts worth more than $ 1 million.

Margin interest rates are subject to change. It would be best if you verified it before any trade decision. However, for now, it starts from 8.5% on a $10,000 balance and then goes up to 7% on over $100,000.

Vanguard accounts below $10,000 funds have an annual fee of $20. This fee is waived if you choose to receive statements electronically. Vanguard charges no fees for account inactivity, account closing or transfer, exercise/assignment, wire receiving, checking, paper statements, or trade confirmations.

Outgoing wires are subject to a $10 surcharge, both domestic and international.

InvestEngine Fees and Rates

InvestEngine pricing is relatively straightforward and divided into sub-categories: Managed and DIY portfolios. Managed Portfolio fees will depend on the type of investment. If you choose to go with an income portfolio, the rate will be different, and it will be different for a growth portfolio.

For income portfolio investors, you have to pay a platform fee of 0.25%, and an average ETF fee is 0.25%. At the same time, an average ETF spread fee is 0.07%. It totals 0.57% in terms of annual fees for the Income portfolio.

Even lower fees are charged for growth portfolios. The platform fee is 0.25%, as usual, while an average ETF fee is 0.15%, and an average ETF spread fee is 0.07%. This totals 0.47% in terms of fees for a growth portfolio.

DIY portfolios do not have annual fees, but investors must pay ETF fees and market spread costs.

You don’t have to pay any set-up, dealing or withdrawal fees for the managed portfolio or the DIY portfolio service. That means you can save your profits in terms of lower costs and help you achieve your financial goals faster.

Portfolio Comparison: InvestEngine vs Vanguard

Vanguard Portfolio

It offers different types of portfolios for investors ranging from income and balance to the growth mindset. It all depends on how much you want to invest and what are your goals and risk acceptance levels.

An income portfolio is a dividend-paying portfolio consisting mainly of coupon-yielding bonds and stocks that pay dividends. This approach is suitable for those comfortable with low risk and who have a short to medium-term investment. Remember that dividends and returns may be taxable depending on which Vanguard account type. In an income portfolio, you can invest in either 100% bonds, 20% Stocks:80% bonds, or 30% Stocks:70% Bonds.

Balanced Portfolio is the next option for investors. To reduce volatility, it will invest in stocks and bonds. The approach hidden in this type of investment requires that you can accept short-term price fluctuations and overall moderate growth. Similarly, the investment term ranges from mid to more extended periods. In a balanced portfolio, you can invest in either 40% stocks:60% bonds, 50% Stocks:50% bonds, or 60% Stocks:40% Bonds.

A growth portfolio primarily aims to achieve higher income in long-term investment. Moreover, this portfolio is a mix of stocks having higher chances of appreciating in the foreseeable future. It also considers short-term volatility and the possibility of large price swings. This portfolio is best for investors willing to take on high risks and have a long-term investment mind with no short-term income goals. In a growth portfolio, you can invest in either 70% stocks:30% bonds, 80% Stocks:20% bonds, or 100% Stocks.

InvestEngine Portfolio

InvestEngine-managed portfolios are fully managed with Robo-advisors just like other competitors. It will ask a few questions to understand your level of risk acceptance and appetite. Two options are available Growth portfolio and an Income portfolio for people looking toward fully automatic options.

Growth portfolios aim to achieve capital growth as the primary objective. In other words, the prime aim is to increase stock value. Portfolios that include growth companies primarily focus on reinvesting their profits in future development, such as acquisitions or research.

An income portfolio is designed to provide periodic income on a quarterly or annual basis. The profit you earn is usually available in your linked bank account. The amount you make depends on dividends earned from your portfolio’s ETFs.

The DIY option allows you to pick and invest in the ETFs that you like. There are over 150 funds available, which include ESG and thematic opportunities. After choosing which ETFs you invest in, you can select how you will balance them. That means the investment ratio is also in your control for each type of ETF.

Moreover, InvestEngine provides a one-click rebalancing option, a unique feature but entirely feasible. That helps your portfolio to remain balanced regardless of the market up-downs. Moreover, specific ETF trades do not need manual balancing; one can do buying and selling on portfolio weights.

Account Options: InvestEngine vs Vanguard

Vanguard Account types

Vanguard offers different types of accounts for different investment needs; you have to decide which account suits your needs. If you are not self-employed and want to start saving for retirement, then opt for IRA, either Roth or Traditional. While on the other side, if you are self-employed or own small companies, simplify your retirement plan with an individual 401(k), SEP-IRA or SIMPLE IRA. If savings are not for retirement purposes, you can open a personal account for an emergency fund or any other type of need, including a house fund.

If you want to save for education for yourself, your child, grandchild or anyone else, then opt for a 529 plan or UGMA/UTMA account.

Vanguard also offers organization and trust accounts to cater to large entities’ needs.

InvestEngine Account Types

A personal account by InvestEngine is a general investment account for an individual. Starting with this account will require £100, just like the other accounts. You may have to pay income tax on profits greater than £12,300. Both managed, and DIY personal accounts are available. While personal accounts cannot be tax-exempt, withdrawals are free of charge.

InvestEngine ISA allows you to use your annual ISA allowance for tax-free investments. An allowance is available for each tax year up to a limit on which there is no need to pay tax on profits. This account allows you to invest up to £20,000 per year. The good news is that capital gains and dividends are tax-exempt. Currently, only managed portfolios are available under this, but DIY ISAs will soon be available. You can withdraw at any time by transferring an existing ISA to a broker. However, sometimes delays adversely impact allowance.

The business account is also available to entities with money to invest and earn extra income on surplus money while readily available when needed. There is no limit on how much you can invest in the business account per tax year. Moreover, capital gains and dividends are subject to tax depending on your business category. Both managed, and DIY portfolios are available for investments for business accounts.

Who is Winner, Vanguard or InvestEngine?

You may have read the above and will most likely be able to decide which platform is best for you. But it all depends on your needs and requirements, along with your investment goals. You must determine if you prefer a managed portfolio or a DIY option. You will also need to decide which type of account you want, such as an ISA/pension account or Vanguards’ ETFs.

Both Vanguard and InvestEngine offer the lowest fees for managed portfolios. On the contrary, currently, InvestEngine is offering the best rates for DIY ETFs in the UK.

With the low fees combined with the vast array of available ETFs and the platform’s additional features, InvestEngine is the best option to go with.