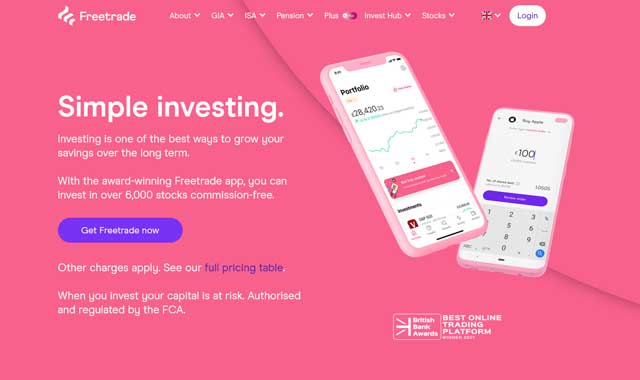

FreeTrade Review 2022: In 2016, Freetrade came into existence. Freetrade is a platform for stock, ETF, and investment trust trading. The (FCA) Financial Conduct Authority regulates Freetrade. It’s a UK-based fintech business that offers commission-free stock trading.

A standard investing account offers commission-free trading, zero transaction costs, and zero platform fees. Freetrade is a UK-based startup that introduced its mobile app in 2018 for the sake of investors’ comfort and ease of access.

FreeTrade Review: Fees, Pros and Cons, Alternatives

Freetrade Pros and Cons

Freetrade allows users to trade stocks and ETFs for free. Opening an account is simple, fast, and completely online. The user-friendly mobile trading interface is well-designed.

You can only trade stocks and ETFs with Freetrade, whose offerings focus on UK and US investors. Only basic charts are available in the insights section. One can only use debit cards to make deposits; withdrawals are impossible.

How Does Freetrade Works?

Traditional DIY investment platforms might be costly when it comes to stock trading. That is because leading firms like Hargreaves Lansdown, AJ Bell, and Interactive Investor focus on investment funds. Freetrade, on the other hand, is completely focused on stocks.

You may start building your portfolio for as little as £1, and there are no costs for purchasing or selling, and trades are completed instantly. You can buy stocks, and exchange-traded funds (ETFs) in the UK, the US, and Europe listed companies. A basic trading account is free, except for transaction fees and ETF charges. Keeping your shares in an ISA will cost £3 per month. For cash deposits, there are two possibilities. Use a bank transfer, debit, or credit card to make your payment.

A bank transfer may take some time to process, but a card payment is immediate, allowing you instant trading. Freetrade funds can be transferred from the app to the same bank account without charges. A selling transaction takes two days to settle, so cash is not available for instant withdrawal.

What are Freetrade’s Charges?

The Basic account with standard features is completely free. One can buy, sell, and hold stock in FreeTrade’s basic account. If you want to receive tax-free interest and dividends, there is an option for ISA; But it comes with a monthly charge of £3. When anyone buys US stocks, the price will consider the exchange rate of 0.45% in the total amount.

- Accounts for general investments are free.

- ISA for stocks and shares costs £36 per year.

- SIPP costs £7/mo for Plus members and £9.99/mo for standard free users.

- Freetrade Plus account costs £9.99/mo

- Buying and selling assets are completely free.

- Deposits and withdrawals are free of charge.

Is Freetrade Expensive For Me?

DIY platforms like Vanguard, Fidelity, or Hargreaves are better for portfolios under $10,000 investment due to the £3 monthly ISA charge by FreeTrade. Investment goals are important to consider when deciding which investment platform to use. The limited array of Freetrade investment portfolios may be worth it, or maybe not. It depends on whether you should save on platform expenses, any attached transaction fees, or go for another investment firm.

Is My Investment Safe with Freetrade?

The FSCS (Financial Services Compensation Scheme) would compensate you if Freetrade went bankrupt. The FSCS will insure assets up to £85,000. There are simple online submissions for claims, which are free.

Note: If your investments lose value or a firm in which you own stock goes bankrupt, you will not be eligible for the claim; Until there is a clear indication that the financial advisor’s suggestion causes loss. The advisor must also go bankrupt to get eligible for the claim.

How to Open a Freetrade Account

The account sign-up is a simple and easy process. You will need to download the FreeTrade app either on iOS or Android. Although a website is available, it offers learning resources, reviews, and community chats.

New customers signing up for a basic account with Finance and Credit Referral Link are eligible for a FREE SHARE valued up to £200* (terms apply). The FreeTrade account setup takes only a few steps after you have the app on your phone. To activate your account, enter the verification code you receive in your email.

You are ready to trade once you have submitted your personal information, such as your name, address, date of birth, and national insurance number. Users can use Apple or GooglePay to make deposits or link their favorite bank accounts. The app can find past performance and price and search for any stock or ETF from popular companies. The app also lets you buy or sell from your investments, while on the other side, it also helps to keep an eye on your portfolio performance.

Popular FreeTrade vs. Comparisons

Freetrade vs. Moneybox

Although Freetrade offers a low-cost alternative to investing in stocks, Moneybox allows you to gain market exposure without hard work. The Moneybox app keeps checking on your bills. It will then invest any change leftover in multiple products (ISA, LISA, Savings accounts, etc.) of your choice. The app links itself to your bank account and collects purchasing data. Moneybox LISA and ISA are free, while the ISA for stocks and shares has a small cost of £1 per month. There is a 0.45% annual fee for platform management.

Moneybox focuses funds on ISA investments rather than stocks. But when you look at fund charges and portfolio fees, it may become more expensive in the long run. For further details, MoneyBox Review can help you out.

Freetrade vs. Trading 212

One of Freetrade’s main competitors is Trading 212. Both platforms provide a low-cost, user-friendly solution to trade stocks and ETFs. Compared to Freetrade’s 6,000 listed stocks, Trading 212 offers a wider range of 10,000 shares from listed companies in the US, UK, and Europe. For an ISA, Freetrade charges a monthly £3. However, Trading 212 ISA is free. When new users join Freetrade, they will receive a free share worth between £3 and £200*. Check out the full ‘Trading 212 review’ for an in-depth overview.

Freetrade vs. eToro

If you are looking to start trading with eToro, then a $10 deposit is the minimum amount you can start. On the other hand, with Freetrade, the minimum investment can start from just £2. If you start investing with eToro, you have to pay a 0.5% exchange fee and a flat $5 for each withdrawal. Although FreeTrade and eToro do not charge any trade commission, there are some upfront fees.

What is Freetrade Plus

It is a paid plan from FreeTrade for investors wanting in-depth details and additional features. With FreeTrade+, some extra services are available, including new stocks, & services, investment loss alerts, and more.

Users of Freetrade + earn 3% interest on cash every month and get free access to stocks & shares ISA (It’s paid service for standard users). The monthly cost of a FreeTrade + account is £9.99.